The Minnesota Senate passes SF 1750

The Minnesota Senate convened today to debate and vote on SF 1750, a bill that, along with its Minnesota House companion, HF 1268, proposes significant amendments to the Minnesota Common ...

RECENT ARTICLES

HOA Day at the Capitol

Attention all Homeowners Association (HOA) owners, board members, property managers, and concerned community members! Now is a critical moment ...

SJJ Attorney Finn Jacobsen Testifies on HOAs and Unintended Consequences of Proposed Legislation

On March 13, 2025, SJJ Attorney Finn Jacobsen testified before the Minnesota Senate Housing Committee, addressing concerns over SF 1750, a ...

Minnesota Court Upholds 14-Factor Subcontractor Statute

SJJ posted recently about a court challenge to the recently enacted subcontractor classification statute, Minn. Stat. § 181.723. The plaintiffs ...

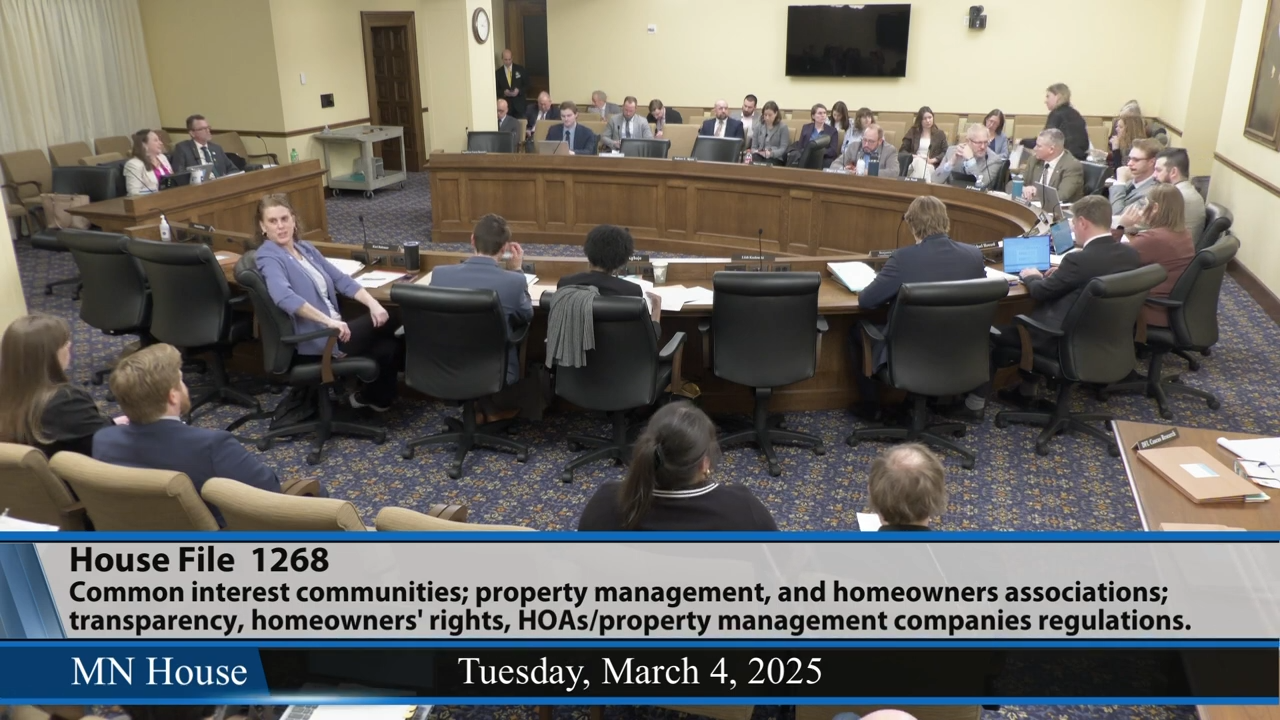

SJJ Attorney Aaron Brooksby Advocates for Homeowners Associations at Minnesota House Committee Hearing

On March 4, 2025, SJJ Attorney Aaron Brooksby appeared before the Minnesota House Housing Finance and Policy Committee to provide ...

Breaking News on Minnesota’s New Subcontractor Law

A recent lawsuit has been filed challenging the constitutionality of Minn. Stat. § 181.723 that passed last year. In the ...

Corporate Transparency Act Injunction Lifted; January Deadline Reinstated

As you may know, the Corporate Transparency Act (CTA) reporting requirements were temporarily paused earlier this month due to a ...

SJJ Law Attorneys Named as Super Lawyers & Rising Stars

We are pleased to announce that eight of our attorneys have been selected for the 2024 Colorado & Minnesota Super ...

Be Prepared: Tax Preparation & Filing

Tax filing deadlines (April 15 for individuals, partnerships, and LLCs; March 15 for S-corporations) are rapidly approaching. With 2022’s financials ...

SJJ Victory at the Minnesota Court of Appeals: Round Two

Smith Jadin Johnson attorneys Steve Moore and Charles Austinson collaborated again to achieve victory at the Minnesota Court of Appeals, ...

Ohio Court Orders that “Matching” is Appropriately Determined by Appraisal

Recently, a significant decision was made in the ongoing legal battle between Cinnamon Ridge Condominium Association, Inc. and State Farm ...

MINNESOTA: Legislature Looks to Address Rising Insurance Premiums

One distressing trend that has become all too familiar for Minnesota residents is the rising cost of homeowner’s insurance. An ...

Material Matching in Colorado: Bertisen v. Travelers

Matching coverage is a type of coverage available under most policies that ensures when a claim is filed for a ...

MINNESOTA: Update to Important Insurance Claim Deadlines

A common question we are asked is how long a policyholder has to complete the claims process after a covered ...

SJJ Law Wins Another Important Case Against State Farm in Minnesota

SJJ attorneys Tim Johnson and Jordan Vassel recently won an important case against State Farm. A homeowner suffered a water ...

District Court of Colorado Revisits Legal Process for Challenging Appraisal Awards

Recently, the district court of Colorado revisited the legal process for challenging an appraisal award. Specifically, the Anita Court clarified ...

Minnesota General Contractors: Legislative Changes for 2024

The 2024 legislative session included many changes that will impact residential contractors. Worker Classification Beginning on July 1, 2024, the ...

Wage and Benefit Liability for Minnesota Construction Contractors

A recent addition to Minnesota wage protection laws impacts construction contractors and their relationship with subcontractors. Contractors are now responsible ...

Ross Hussey Scores Another Trial Win

Ross Hussey recently secured an award after a two-day trial in McCloud County District Court of approximately $230,000 on behalf ...

Wisconsin Residential Contractors: Protect Yourself from ATCP Claims

Wisconsin’s home improvement consumer protection laws were created under the purview of the Wisconsin Department of Agriculture, Trade and Consumer ...

Tips for Property Owners Beginning Large Construction Projects

When entering into a construction contract it is important that a property owner take measures to protect themselves from possible issues that may arise. The most common disputes between property owners and contractors stem from miscommunication. It may have to do with the scope of work performed, the cost of the project, or the amount of time for completion. Below…

All Minnesota General Contractors Must Create a COVID-19 Preparedness Plan

The Department of Labor and Industry Requires All Minnesota General Contractors Create a COVID-19 Preparedness Plan Following Governor Walz’s executive orders, all General Contractors in Minnesota (and any business engaged in the construction trades), must develop and implement a COVID-19 Preparedness Plan. The plan will outline the obligations and duties of the General Contractor in regards to the safety of…

The Minnesota Senate passes SF 1750

The Minnesota Senate convened today to debate and vote on SF 1750, a bill that, along with its Minnesota House ...

HOA Day at the Capitol

Attention all Homeowners Association (HOA) owners, board members, property managers, and concerned community members! Now is a critical moment ...

SJJ Attorney Finn Jacobsen Testifies on HOAs and Unintended Consequences of Proposed Legislation

On March 13, 2025, SJJ Attorney Finn Jacobsen testified before the Minnesota Senate Housing Committee, addressing concerns over SF 1750, a ...

SJJ Attorney Aaron Brooksby Advocates for Homeowners Associations at Minnesota House Committee Hearing

On March 4, 2025, SJJ Attorney Aaron Brooksby appeared before the Minnesota House Housing Finance and Policy Committee to provide ...

Understanding the Corporate Transparency Act: What Community Associations Need to Know

As of January 1, 2024, the newly enacted federal Corporate Transparency Act (CTA) is in effect. This legislation has significant ...

COLORADO: Insurance Claim & Deductible Assessment Policies for CCIOA Communities

One of the biggest challenges facing homeowners' associations today is the affordability of property insurance. There are three main problems: ...

Essential Invoicing Practices for Small Business Owners

As a small business owner, managing numerous daily tasks often leaves invoicing as a secondary concern. While using online templates ...

United States Supreme Court Eases Path for Job Transfer Discrimination Lawsuits

In a recent ruling, the US Supreme Court made it easier for employees to bring lawsuits against their employers alleging ...

The FTC Officially Bans Noncompete Agreements

On April 23, 2024 the Federal Trade Commission approved a new rule effectively banning the use of noncompete agreements between ...

MINNESOTA: New Employee Classification Legislation

There has been an ongoing movement to focus on the classification between employees and independent contractors both at the federal ...

Department of Labor Issues New Rule Regarding Independent Contractors

One of the biggest issues facing companies, especially in the building and remodeling industries, is whether a worker is an ...

Minnesota: Corporate Compliance – Simple Steps to Protecting Assets

Minnesota law requires all businesses to maintain proper corporate formalities. Every business owner knows that one must set up some ...

The Minnesota Electronic Wills Act

On March 30, 2023, Governor Tim Walz signed the Minnesota Electronic Wills Act, which, as the name sounds and as ...

It’s Time to Check Your Beneficiary Designations

Many people hold a good portion of their net worth, including most of their liquid assets, in accounts that have ...

Who’s in Charge Now? Succession Planning for Business Owners

If you are the owner of a business, you know that you can’t run it forever. Like taxes, retirement and ...

Probate Part III – When Probate Should Be Avoided

In part three of Smith Jadin Johnsons series on probate, this post discusses the scenarios when drafting a revocable trust as a client’s main estate planning device, and subsequently avoiding probate, makes the most sense. Depending on the type of estate, revocable trusts can be the preferred method of asset distribution for estates that are complex and for estates that require control over assets and/or privacy.

Probate Part II – When Probate Is Preferred

In part two of Smith Jadin Johnson’s series on probate, this post discusses the scenarios when drafting a will as a client’s main estate planning device, and subsequently probating the will, makes the most sense.

Probate Part 1: Is It a Four Letter Word?

For many people, when they hear the word “probate” it conjures up something to be avoided like the plague. Most of that stems from misunderstanding the process and procedure. This is the first of a three part series in which Smith Jadin Johnson explains when probate is appropriate for clients and when it should be avoided.