Understanding the Corporate Transparency Act: What Community Associations Need to Know

As of January 1, 2024, the newly enacted federal Corporate Transparency Act (CTA) is in effect. This legislation has significant implications for various business entities across the United States, including ...

RECENT ARTICLES

Colorado – Marshall Fires: Insurance Claims in Community Associations

In late December 2021, a wildfire ripped through Marshall, Colorado, an area located in Boulder County between Boulder and Denver. ...

U.S. Court of Appeals Rules that Minnesota Appraisal Panels Must Determine the Cause of Loss

SJJ attorneys Tim Johnson and Brad Hammond recently obtained a victory with the 8th Circuit Court of Appeals in a decision ...

A Breath of Fresh Air: Banning Smoking in Homeowners Associations

Smoking is a controversial issue within homeowners’ associations. Members who have owned their units for years proclaim their right to ...

SJJ’s Tim Johnson and Marcus Zelzer Win Again for Policyholders in Iowa

Smith Jadin Johnson attorneys Tim Johnson and Marcus Zelzer recently won a motion to compel appraisal in Iowa ordering an insurance company ...

Who’s in Charge Now? Succession Planning for Business Owners

If you are the owner of a business, you know that you can’t run it forever. Like taxes, retirement and ...

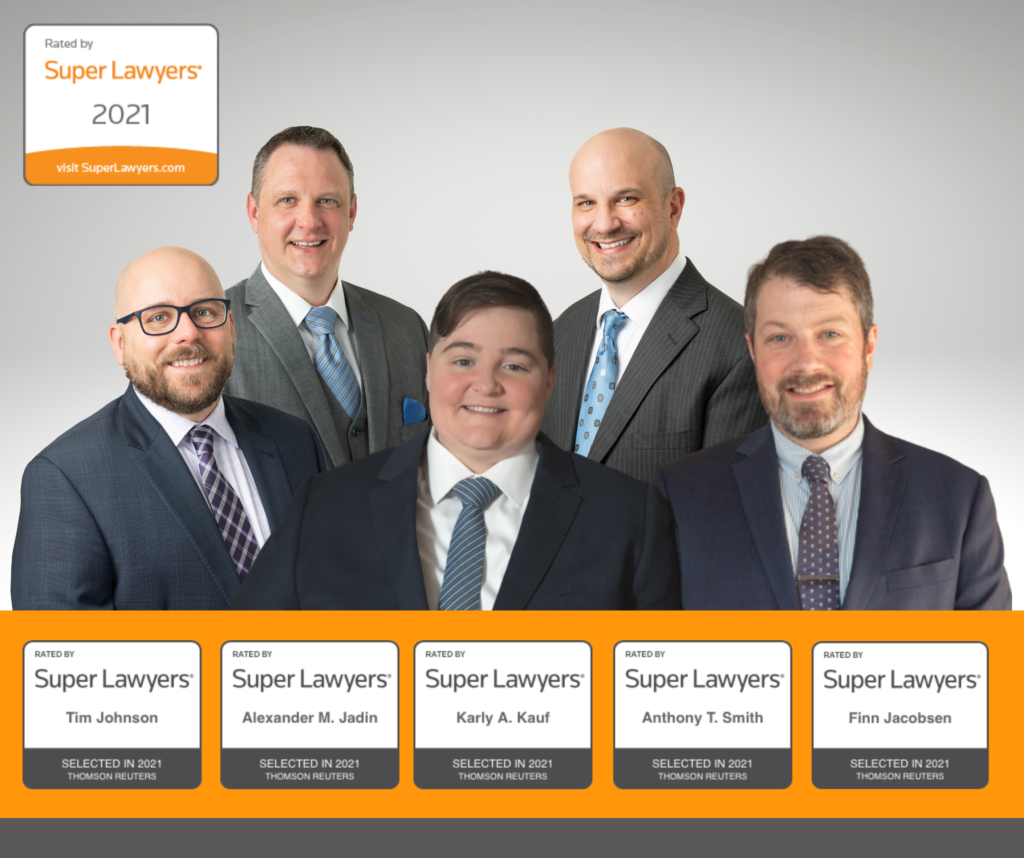

Tony Smith, Alex Jadin, Tim Johnson, Finn Jacobsen & Karly Kauf Named Super Lawyers & Rising Stars 2021

Super Lawyers is a rating service of outstanding lawyers from more than 70 practice areas who have attained a high-degree ...

Insurance companies refuse payouts after hailstorms

Colorado homeowners are facing serious damages as a result of hailstorms throughout the state. However, when they file a claim with their homeowners’ insurance policies for the storm damage, they are facing delays, denials and lowered estimates that could hinder their opportunity to recover from the damage caused by the hail. In the past decade, homeowners and businesspeople in the…

What to know about storm damage claims

When a storm hits in Colorado or other states, it is possible that it could cause damage to a person’s home. However, there is no guarantee that an insurance policy will cover the cost of repairing that damage. In some cases, an insurance policy will damage caps or other limits that may leave a homeowner paying for some repairs out…

How to file an insurance claim

Those who have an insurance policy may feel at ease knowing that there is financial protection in case of emergency. However, the process of filing a claim after a natural disaster or other event that causes damage may be confusing to policyholders. The first step in the process is to review the policy itself to get a better idea of…

What Winter Home Repairs are Covered by Homeowners Insurance

Winter in Minnesota is brutal. Snow accumulates, and when the sun shines, it melts and turns into ice. When you combine these wintry elements with freezing temperatures, it creates particularly dangerous conditions. This can cause issues in your home. You may wonder if winter home repairs are covered by homeowners insurance. Here is what you need to know about a…

Hail damage costs billions nationwide each year

Anytime a large storm hits, you hear about the hail damage. But how much does that damage cost Americans each year? The Insurance Information Institute states that 2017 saw 6,045 major hail storms, which caused about $1.8 billion in crop and property damage. When combined with wind damage, that figure rises to well over $2 billion. Where does hail hit…

Duty to Cooperate in Property Damage Claims

An insurance policy is a contract that is binding and enforceable on both the policyholder and the insurance company. Within the policy, both parties have certain obligation and duties. The “duty to cooperate” is one of the most important policyholder duties. From a practical viewpoint, the duty to cooperate requires the policyholder to allow an insurance company to investigate the…